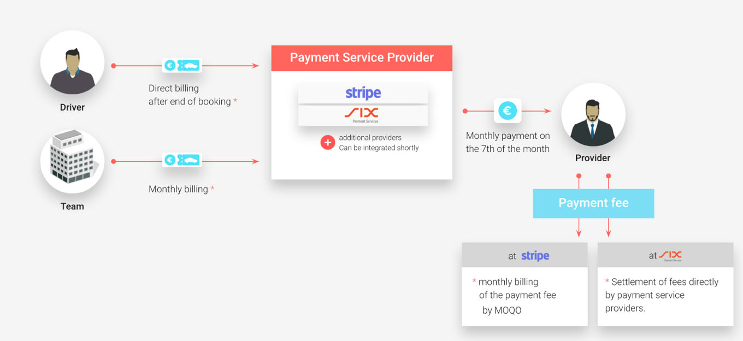

How payment providers differ, how the innovation affects end customers and what role MOQO plays in this is briefly explained below.

1. Why do providers need a payment provider?

Online payment services are the financial interfaces between providers and end customers. They ensure that the flow of money is clean. Stripe enables the transfer from the user's account to the provider's account. Following a chargeable booking in your sharing offer, the invoice is issued and the costs are collected from the user's account. MOQO only acts as a technical infrastructure for the payment processing from end users to providers - the payment services are integrated in the MOQO system.

2. choose the right payment provider - what options are available?

Stripe is the standard payment provider at MOQO. Beside that providers can decide to use PayUnity by Six Payment Services. Depending on which option you choose, you will be faced with different tasks.

2.1 Stripe as payment provider

Stripe is the default online payment service on the MOQO platform. You as a provider store your master data in the MOQO portal, which is then automatically transferred to Stripe. Providers receive the collected amount of all bookings of a month on the 7th day of the following month. For this service Stripe charges fees based on the gross turnover to MOQO, which are then invoiced by MOQO to the provider.

Important: Customer deposits are paid out in full to the provider.

No commissions are withheld.

2.2 Six Payment and other payment providers

As a provider, you may already use a payment provider in other projects. MOQO is expanding the list of payment providers step by step so that you can continue to operate in your familiar environment and use services that you have already implemented. PayUnity by Six Payment Services is the next building block that will be available for you shortly. In cooperation with MOQO, the company from Switzerland offers you an integration process similar to the one with Stripe. Due to the modular structure of the MOQO platform, additional payment service providers can be implemented at short notice. Please contact us to get more information about possible partner services.

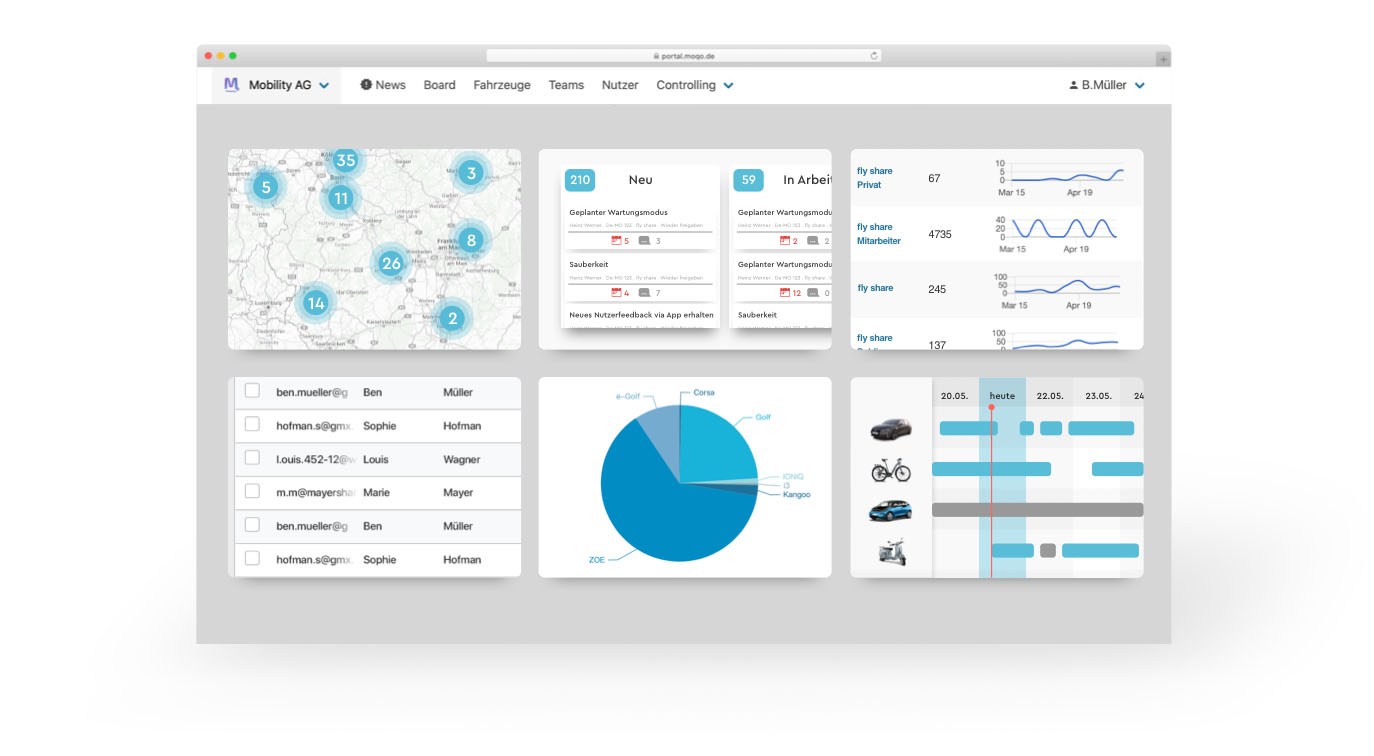

3. Full Transparency

No matter which payment provider you choose: You will find all payment transactions clearly arranged in the MOQO portal. Open payments, power users, monthly overviews, payment flows and bookings - you have the full overview and can operate accordingly. All information can be exported in common exchange formats for further processing.

3.1 Automatic invoicing

MOQO offers Pro, Plus and Premium Plus partners the automatic billing feature. With this feature, drivers receive an automated invoice by e-mail following a chargeable booking. As a provider, you can view and download all invoices in the portal.

4. The customer and his payment options

4.1 SEPA Direct Debit

The SEPA Direct Debit Scheme is already activated with almost all providers, so that it can be used conveniently for payment.

However, the default risk for SEPA Direct Debit is significantly higher than for payments by credit card or PayPal. (End users have the possibility to block or object to payments up to 6-8 weeks after the bookings). In rare cases, it is possible that the user's account is not covered and thus the payment fails. In this case Stripe will charge a fee of 7,50 € to MOQO, which will be forwarded to the provider.

Nevertheless, according to a study by ibi Research, 46% of users surveyed consider SEPA Direct Debit to be one of the most user-friendly payment methods. 38 % of those surveyed have used the option within a period of 12 months. SEPA direct debit is most popular among users aged 26-35 years.

4.2 Credit Card

Compared to SEPA payments, the default risk for credit card payments is significantly lower. However, not every user has a credit card. Nonetheless, most ibi research respondents use their credit card more often than SEPA payments.

44% state that they have paid online by credit card at least once in the last 12 months. It is most in demand among 36-45 year-olds.

The Payment System at a Glance

MOQO offers partnerships with strong payment providers. In the MOQO app they can choose between SEPA and credit card depending on their preference. End users can deposit a primary means of payment, but can easily switch between deposited means of payment if required.